Discover essential FX hedging strategies and currency management best practices from our foreign exchange experts.

FX Gains and Losses: the timing is key

In terms of FX gains and losses, choosing when to hedge has profound impacts on various aspects of a company’s financial reporting. As we discussed in our previous article on under and over-hedging, firms can quickly bring unwanted gains and losses onto their income statements through less-than-optimal hedging-strategies. Moreover, just like not covering or over-covering FX risk can have adverse impacts, so too can waiting to hedge. Standard practice in many firms dictates that in place of pre-hedging sales, they should instead hedge at month end. While this technique might prove more convenient since they already know the exposure amount and receivable, it still doesn't adequately protect the books. Indeed, FX gains and losses can and do occur under this strategy.

Always on the move

Let's take an example. In addition to selling goods in the eurozone, a French e-commerce merchant also sells to customers in the UK, pricing in British pounds. At the end of each month, the finance department calculates their total sales in these currencies – i.e. their exposure – and takes a forward with maturity date on the day their payment providers in these countries credit them.

Covering exposure with rolling hedges

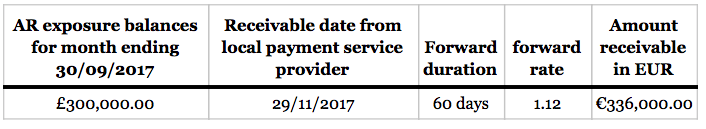

According to their procedures, they would take out a forward contract for settlement in 60 days, buying 336,000 EUR for 300,000 GBP. However, hedging at the end of the month does not reflect the realities of the impacts of the market. Taking a look at the daily GBP sales from the period and comparing it to that particular day's forward rate, another picture emerges. As the GBPEUR went through a period of volatility, the value of each sale in euro differed day-to-day (and, in actuality, minute-by-minute).FX gains and losses from each operation

By the time the end of the month comes, and the company buys their forward contract, the impact on the financial reports becomes evident. Since they waited to hedge until a predefined period, the accounting department had to record an FX loss of 3,400 EUR on that month's income statement.

Preventing time-driven FX losses and gains

Fortunately, firms can avoid these unwanted movements with relative ease. Instead of waiting until the end of a set term to hedge, the finance department should hedge each transaction as they occur. This concept, referred to as micro-hedging, has three primary benefits:

- Companies selling in foreign markets lock the FX rate at the time of sale, eliminate currency-related risks

- Accounting becomes clearer thanks to the conversion already accounted for

- FX gains and losses disappear from financial statements

By taking a forward once the sale hits the accounting system (and of course, the delay between transaction and notification needs to be as little as possible), the receivable’s exposure time diminishes significantly. Understanding the books becomes easier since realisable revenue gets recorded in the functional currency from the time of sale at its sale value (in contrast to only appearing once translation occurs). Finally, FX gains and losses caused by timing issues disappear from the P&L account thanks to the gap between selling and hedging activity vanishes. Of course, in a high-volume sales environment, manually hedging each transaction is a near-impossible task (at least if the goal is to do so without making multiple mistakes). Perhaps, then, this is why FX gains and losses from timing are still prevalent in finance departments. That said, businesses have hedging automation tools at their disposal to better deal with this issue. These software solutions can automatically hedge each transaction as they occur or when passing a pre-defined exposure threshold. Additionally, these products make it possible for companies working in e-commerce, travel, programmatic advertising, and other industries to cover their entire FX-related risk before they harm overall financial reporting.