Discover essential FX hedging strategies and currency management best practices from our foreign exchange experts.

FX gains and losses series: The slippery slope of unhedged conversions

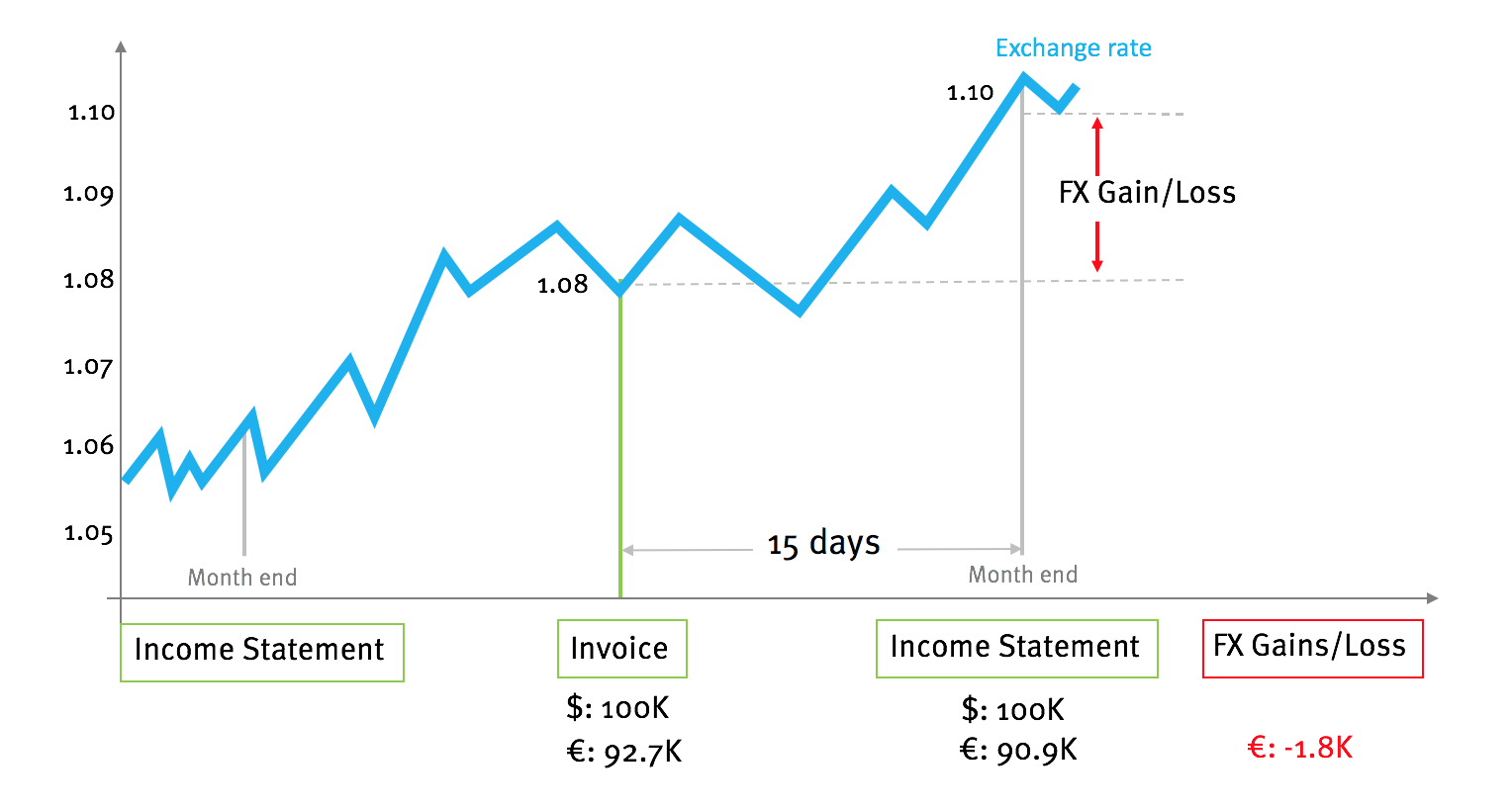

As we explained in the previous article, when you don't have a hedging plan, the relation between exchange rate volatility and foreign exchange gains and losses is unambiguous. What is not that apparent is why those gains and losses can hit companies that do hedge their FX exposure.To understand this phenomenon, we should delve into the dynamics of FX exposure and hedging activity and find out the interaction between them.First of all, we should be aware that every FX conversion involves an exchange rate and, therefore, it has the potential to impact the FX Gain/Loss line unless it is hedged.However, the rate used to convert a sale or a purchase agreement is almost never the income statement rate. Therefore, we can easily see a pervasive source of FX gains and losses.FX Exposure between conversion and income statement

FX gains and losses with hedging processes

Even though most treasurers and financial managers tend to purchase hedging products to reduce risk, the gaps created by the different durations of the currency exposure cycle compared to the hedging instrument is a frequent cause of FX gains and losses.In many cases, those FX discrepancies relate to rolling hedge strategies. For businesses using this approach, it is a common practice to avoid rolling hedges to cover payments expected to settle during the next month. This technique may reduce the hedging costs but leaves the cash flow exposed to FX volatility for days or weeksUnhedged conversions

Intercompany transactions can be another common source of FX gains and losses if the parent company and a subsidiary use different exchange rates to register transactions in non-functional currencies. The branch, for instance, might translate the transaction into their functional currency using a daily spot rate, whereas the parent company records the offsetting transaction using the month-end rate, thus creating an accounting divergence.In these cases, many ERP systems tend to use the income balance rate to reappraise the value of all monetary assets and liabilities and automatically create an entry to register the difference between the exchange rates as an FX Gain or loss.

How to minimise the impact of unhedged conversions

Many companies adopt rolling hedge strategies because they provide a more flexible and adaptable approach to risk management than fixed longer-term "set-and-forget" strategies. However, there are more efficient versions of flexible FX risk management.Nowadays, technology can take you one step further with micro-hedging techniques that allow you to hedge FX risk from beginning to end. This method hedges any exposures when they start: from the invoicing moment to the payment date and not before.Optimising pre-hedging and rolling hedges with technology: Micro-hedging enables companies to hedge their FX operations one by one, from the very moment they send or receive an invoice right until the until payment date. The software tool automatically picks up each exposed transaction as they enter the company's system - be it via ERP or other standardised communication platforms. According to the Treasury's parameters, the hedge gets instructed automatically, with maturity date set for whenever the firm needs the cash for onward use.This strategy liberates them from having to forecast cash flows or rolling hedges forward. The company protects its margins from exchange rate volatility and offsets FX gains and losses.In the case of businesses with repeated FX exposure and multiple small operations on a daily basis, micro hedging strategies can be automated to execute hedges per defined criteria. Some firms hedge the daily accumulated exposure, while others set maximum exposure levels and execute hedges automatically when their holdings of foreign currency reach the pre-defined level.Eliminating FX gains/loss with micro-hedging

Reducing the gaps that create FX gains and losses is an essential element to improve the efficiency of the risk management strategy. It produces more reliable accounting reports and reduces effort and stress for the treasury team in moments of high market volatility. By taking a complete approach to hedging, firms make sure that their P&L receive full protection from FX volatility, making sure that unhedged items don't come back to create future havoc on the balance sheet.In the next article, we will deal with the issue of Under and Over-Hedging. Another common source of FX gains and losses.