Discover essential FX hedging strategies and currency management best practices from our foreign exchange experts.

The Secrets Behind Layered Hedging Programs

Struggling to achieve predictable cash flow and protect your budget from foreign exchange (FX) fluctuations? You're not alone. Many companies grapple with safeguarding their finances against long-term currency risks. This blog post dives into Layered Hedging Programs, a powerful tool for CFOs and treasurers seeking a smooth and automated approach to FX hedging.

Why Continuity in Pricing Matters

Traditionally, FX hedging hasn't offered a one-size-fits-all solution. Companies often face limitations in adjusting prices to counter currency movements. This can be particularly challenging for businesses that prioritise consistent pricing for their customers.

Imagine a scenario where your FX rate is a key component of your pricing strategy. You set prices for the upcoming period. But what happens if there's a sudden, significant currency shift mid-period (known as a 'cliff')? Can you readily pass on this cost increase to your customers without impacting competitiveness?

In situations like this, where price stability is paramount, achieving a smooth hedge rate becomes crucial.

The Power of Layered Hedging for a Smooth FX Hedging Strategy

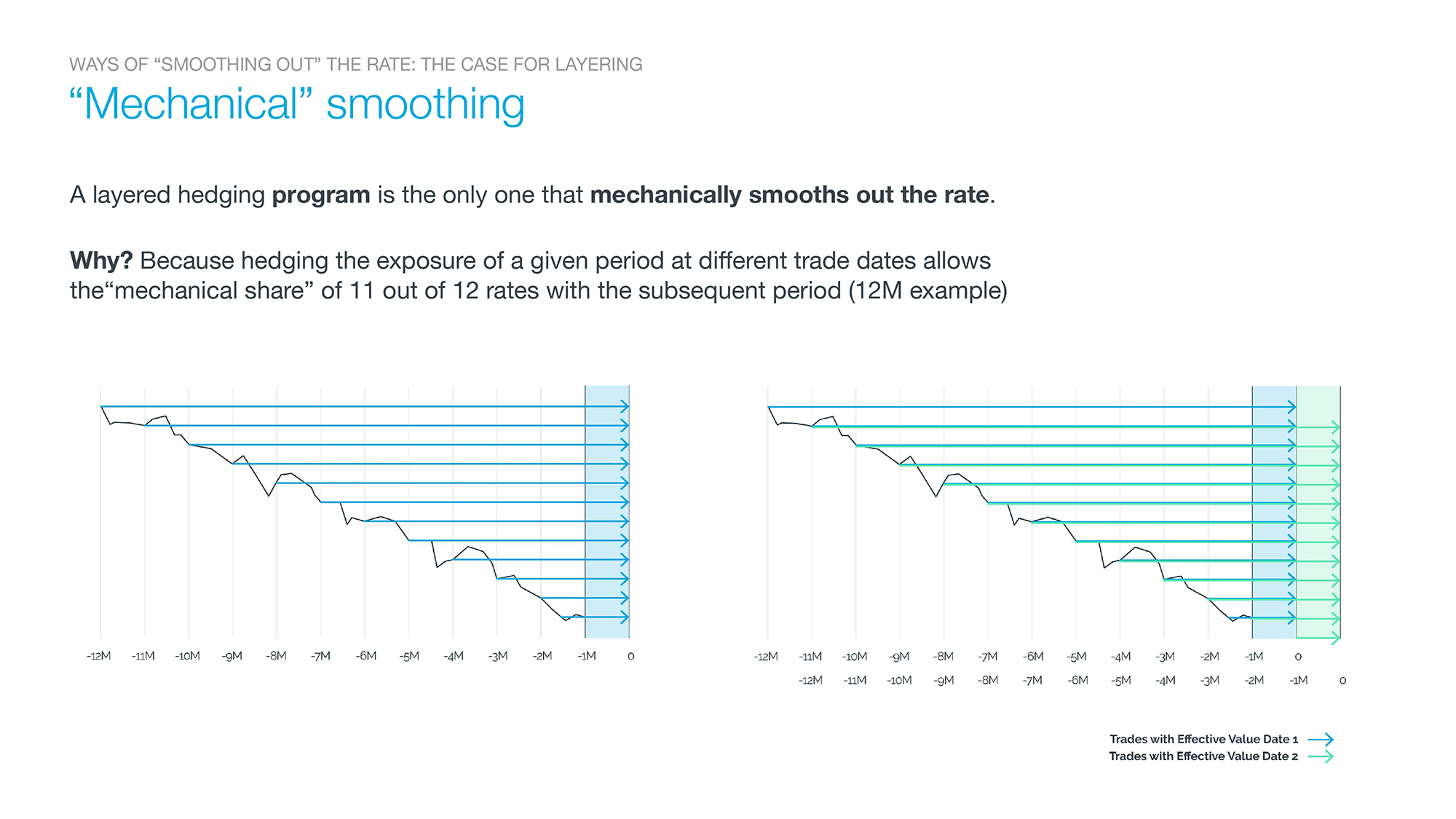

Static hedging programs leave you exposed once the initial hedge matures. Rolling programs can help, but only in scenarios with minimal FX volatility. Layered Hedging offers a solution by systematically applying successive layers of hedges over time.

For instance, let's say you have an exposure projected for August next year. By hedging a small portion (1/12th) of the amount in August of the current year, and adding similar amounts each subsequent month, you'll achieve the complete hedge (100%) by August next year. This approach ensures a gradually smoothed hedge rate.

The Benefits of Layered Hedging

The beauty of Layered Hedging lies in its adaptability. You can tailor it to your specific business needs. Here are some additional goals a Layered Hedging program can address:

- Enhanced cash flow visibility: Gain early insights into your cash flow.

- Optimised forward points: Take advantage of favourable forward points for cost-effective hedging.

- Reduced hedge-spot rate discrepancy: Minimise the gap between your hedge rate and the current market rate.

While time can improve forecast accuracy, the real determinant is the exposure type and its evolution over time. Factors like Sales Orders (SO), Purchase Orders (PO), Accounts Receivable (AR), and Accounts Payable (AP) all influence your FX exposure.

As François Masquelier, Honorary Chairman of the European Association of Corporate Treasurers, rightly points out:

"Visibility is brought by business events as time passes by."

Automating Layered Hedging Programs

The limitations of manual forecasting can be overcome by combining Layered Hedging with programs that hedge SO/PO and even AR/AP. This can be achieved through software that integrates with your existing information systems, automating the entire hedging process.

Layered Hedging Programs, especially when automated, empower CFOs and treasurers to achieve a strategic and proactive approach to FX hedging. This translates to predictable cash flow, minimised risks, and a competitive edge in the global marketplace.

Ready to unlock the power of Layered Hedging? Access our on-demand webinar here to learn more about "The Secrets Behind Layered Hedging Programs".